How to cover the costs of a single family office?

Suppose your immediate answer is from investment management revenues (after taxes!).

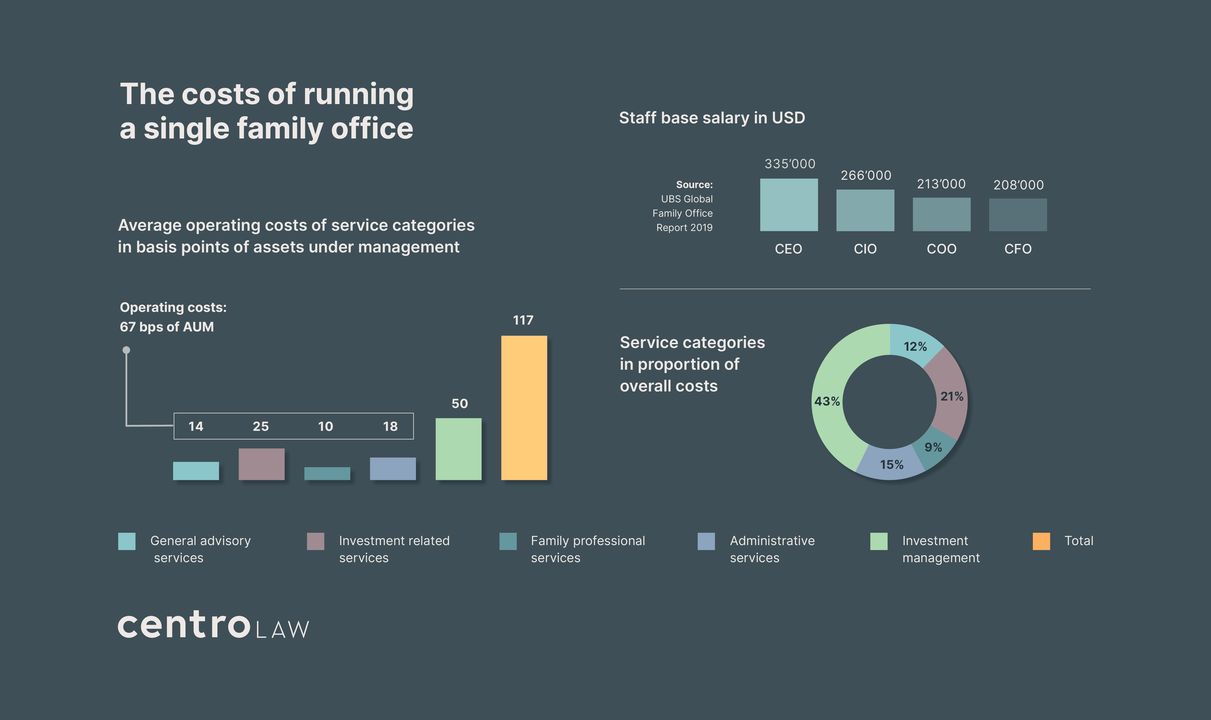

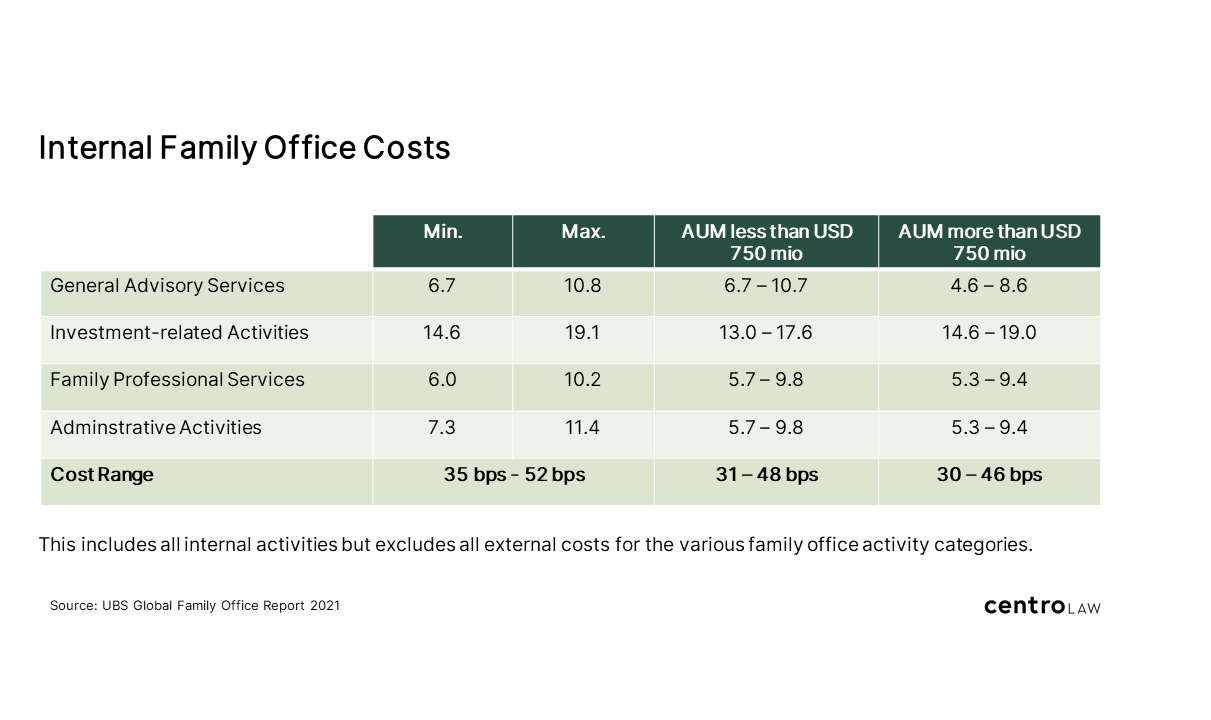

In that case, you also need to deduct the charges for investment management and custody, the costs for core in-house administrative activities and those for outsourced general advisory services to do the maths.

This calculation works if all your assets are bankable. In all other scenarios, you need to consider the added value and cost-savings due to consolidation, reporting, verification, risk management, and management of external experts.

We recommend looking at the added value in terms of efficiency, effectiveness, reduced complexity, and cost control due to the family office oversight.

If your assets are mainly alternative investments, you may be willing to directly bear the costs if the overall result justifies them: imagine a family that primarily invests in alternative investments and expects a significant liquidity event in the future.

Although from the assets under management perspective, the single family office may not pass the thumb rule evaluation test, it can add tremendous value in light of the future liquidity event.

The family may accept the losses for several years since they highly value the single family office's service for their illiquid assets.

Depending on the benefits, costs can be allocated to family members according to consumption or participation in the family wealth.

From digital to virtual family offices

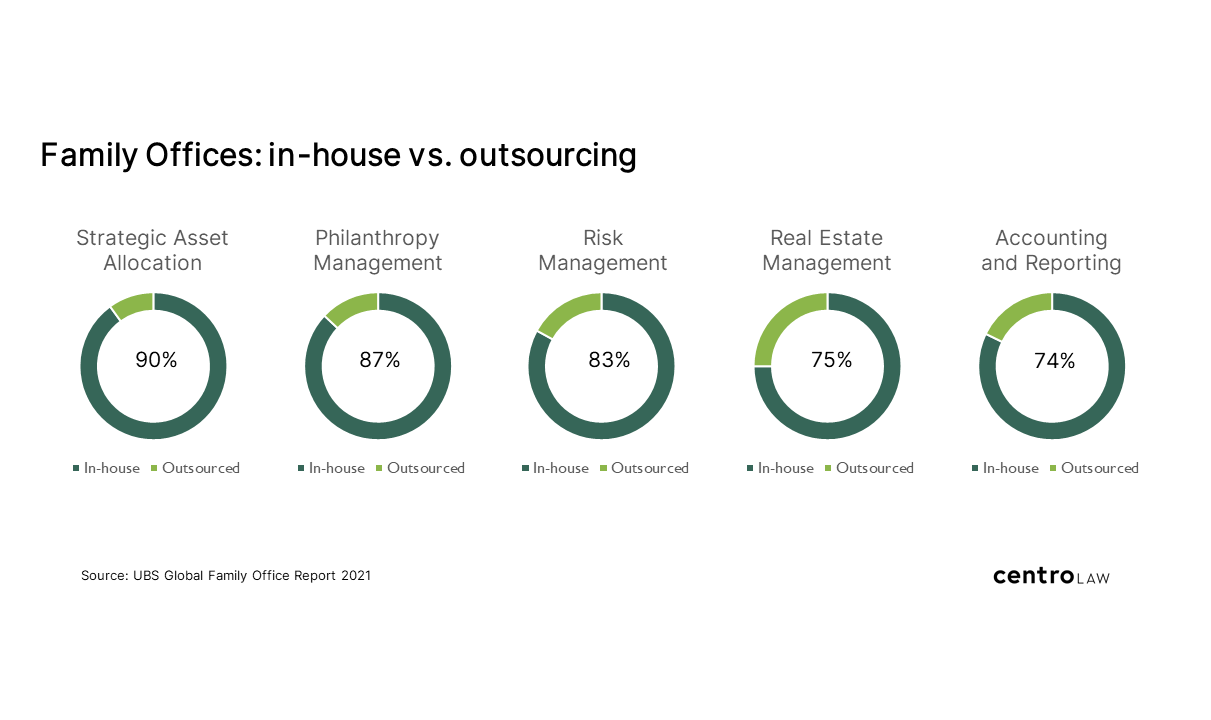

Leveraging technology allows you to go beyond digital and a step further in cost reduction. It's moving from the above outlined digital coordination to the virtual integration of external services.

With a virtual family office, a technology platform integrates outsourced functions into the single family office, and a central in-house team is responsible for the selection, oversight, and integration of external service providers.

With such a structure, in-house running costs can be reduced to a minimum and still achieve favorable results that otherwise may not be possible.

The combination of technology and leveraging external service providers' expertise in an efficient virtual collaborative environment is the secret recipe for overall lower single family office costs.

With such structures, assets under management drift in the background, although consistent budgeting and a transparent fee structure remain critical.

Single family office set-up costs

There are two main cost factors during the set-up phase: i) concept elaboration and implementation and ii) recruiting.

The concept elaboration and implementation include, among other things, a front analysis of costs and benefits, family governance, the family office structure, and governance, a regulatory and compliance framework, an investment strategy, and succession planning.

Also, these costs depend on the individual circumstances, and as with the recurring expenses, you should demand predictable charges from your advisors for this phase of the process.

Hiring and onboarding the right people is a critical success factor for your single family office, and you may seek guidance and assistance from a specialized recruiter.

When should you set up a single family office?

In our opinion, there is no ideal world specific point or stage of wealth where a single family office should be created. As with most of these topics, it all depends.

Individual assessment

We don't believe in the evaluation with percentages of assets under management but in individual circumstances and needs as the basis.

The single family office evaluation process requires an in-depth assessment of the family's situation, and the individual needs to define the required family office service offering.

With such groundwork completed, costs can be predicted and double-checked against industry standards for assets under management.

However, there can be many reasons for a single family office structure that does not pass the threshold test.

The most crucial factor is that you and your family get the desired value out of the system, and you may be willing to bear additional costs for that.

Thus, the costs of a single family office depend on your needs rather than your wealth. And as we mentioned above, it's vital to focus on the strictly necessary when defining the family office's purpose.

A lean structure will also be reflected in the running costs. With the consolidation of the central services, you can add further services, such as family professional services, at a later stage.

A family office ecosystem

Due to technology and external advisors and professionals adapting to a new collaboration and predictable pricing model, the single family office space is evolving rapidly towards platform ecosystems.

Such ecosystems offer attractive features in terms of efficiency, data-based decision making, real-time oversight and control, and substantial cost reduction for single family offices.

Thus, the question of how much wealth you need for creating your single family office may lose its relevance.

Updated 28-01-2022

Contact us to schedule a free consultation to learn more about getting the most value from your individualized family office solution.