We are looking at external asset management following our recent blog post on asset and wealth management. This service offers private wealth owners benefits that traditional banks struggle to compete with, is a hidden power in Switzerland, popular in the United Kingdom and the USA, and on the increase in Hong Kong and Singapore.

This post will look at the external asset management definition, its elements and capabilities, its business model, pricing, regulation, and how to select your external asset manager.

Let us stress that you will find a broad range of definitions and terms for sometimes the same service in practice throughout the industry. Our assessment approaches the field from a private wealth perspective to assist private wealth owners in exploring alternatives to the traditional wealth and asset management offering.

What is external asset management?

External asset managers (EAMs), often referred to as independent asset managers, manage financial assets and investments on behalf of others without taking such assets in custody.

If you work with an EAM, you will still need a custodian, usually a licensed bank, and grant a power of attorney to enable the portfolio management. Such power of attorney is typically limited and does not allow the EAM to withdraw funds.

Independent asset management

EAMs are financial services providers but, in most cases, not licensed as a bank or securities dealer. They are outside and independent of the custodian and therefore free to offer their clients any product or solution. As mentioned, they don't hold their clients' assets since custody remains in their clients' names. Next to discretionary asset management, EAMs also provide investment advice.

No affiliation with banks

Since EAMs are not affiliated with the custodian, they can provide continuity in service provision with the flexibility to adapt to custody requirements changes. Their customer service is often comprehensive and not restricted to standard mandates and product lines. They may offer their own products, mainly collective investment schemes, and as long as they do it transparently, avoid conflicts of interest, and their products are best in class, that should be acceptable.

The EAM value proposition

In its Swiss External Asset Managers Industry Report 2017, Credit Suisse highlights that independence and personal relationships with clients are EAMs' most fundamental unique selling propositions. Independence allows clients to select from a wide range of products and services provided by different custodians.

The EAM may help its clients choose appropriate solutions in a less standardized advisory process than large wealth and asset management companies.

The main challenge for EAMs in their relationship with clients is changing personal circumstances. In particular, wealth transfers to the next generation result in pressure to prove value to younger generations.

The external asset management business model

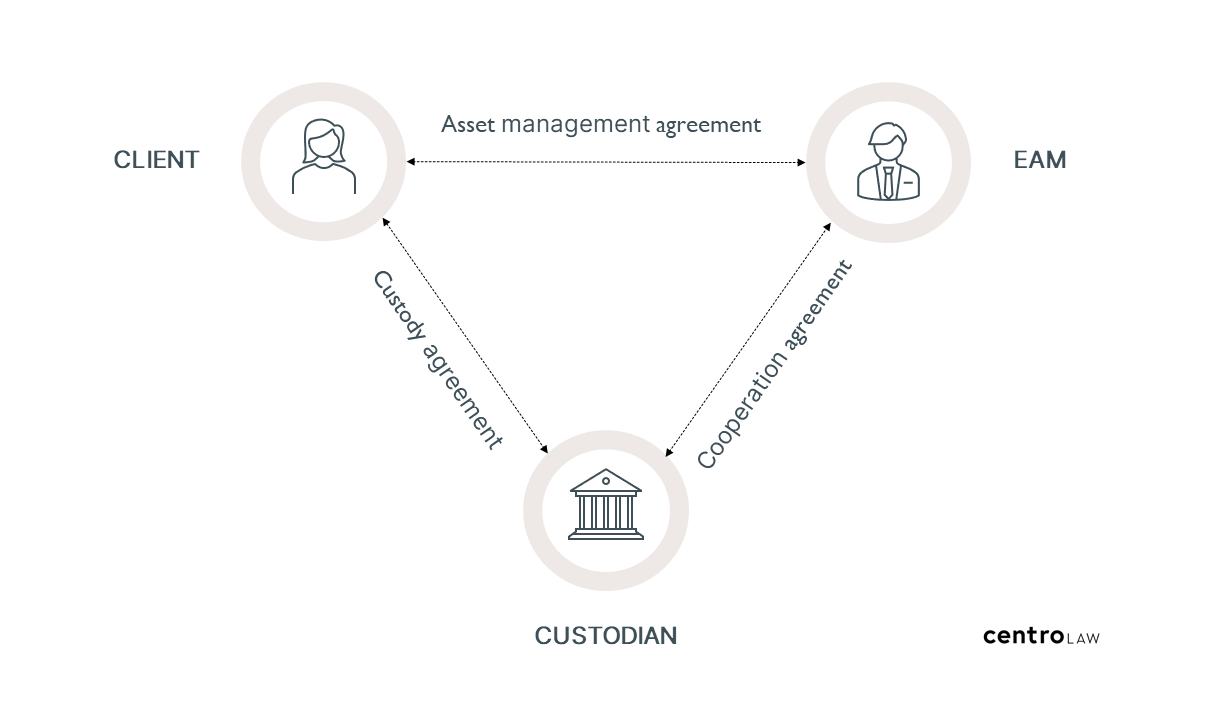

You enter three contractual relationships when working with an external asset manager.

The contractual relationships

First is the investment advisory or asset management agreement with the EAM, then there is the custody agreement with the custodian. Lastly, the EAM and the custodian will enter into a cooperation agreement.

Although the EAM manages your assets and makes investment decisions within the agreed investment strategy, you can still receive additional services from the custodian.

Alignment of interests

In its ideal form, the EAM model aligns interests for tailored and flexible solutions. Clients receive individual services and can expect continuity without depending too much on a service provider. EAMs focus on the relationship with their clients and provide sophisticated asset management services.

Those who value personalized assistance from a specialized and small financial intermediary will also appreciate the entrepreneurial commitment of the EAM sharing risks with clients. In most cases, the relationship with the custodian is not decisive for clients since they will only hold the EAM accountable for the results.

The partnership between EAM and custodian

However, the partnership between EAM and custodian is an essential factor for quality and client satisfaction.

The onboarding process is one example of collaboration between EAM and custodian that substantially impacts the client journey. Data transmission and processing between them is another critical parameter for service delivery.

The triangular relationship of the EAM business model delivers the best results when interfaces match optimally.

Why are custodians working with external asset managers?

Most custodians offer the same services as EAMs. Still, they recognize their importance and offer dedicated EAM platforms and teams.

Revenue potential

Although revenues are smaller, acquisition and ongoing administration costs are lower than in wealth management service provision. It makes sense why custodians don't want to miss out on this opportunity. They remain in contact with the client if things change over time and have an additional distribution channel for their products.

Enhanced client service due to collaboration

In Switzerland, for example, several custody banks have founded the Blockchain Association for Finance to set standards for collaboration between banks and external asset managers. A platform based on blockchain technology enables improved information and data exchange between custodians and EAMs.

This simplifies compliance procedures, digitizes the entire onboarding process, ensures high data quality, and frees up resources for client services.

External asset management services

According to the Swiss Association of Asset Managers, an industry association of independent asset managers, EAMs maintain a trusted relationship with their clients.

Comprehensive financial advice

They recognize their clients' financial needs and advise them on their investment requirements, objectives and strategies. They inform their clients about the risks associated with investments and account for the services they provide.

One-stop shop

EAMs open accounts and custody accounts for their clients with appropriate banks and manage their custody assets following the defined investment strategies based on powers of attorney issued by them.

They select financial instruments and solutions that meet clients' needs and imposed restrictions, transmit orders, and monitor their execution.

EAMs are experts in the field and have in-depth knowledge of the construction and structuring of the portfolios and assets they manage.

Core services

The EAMs core service profile includes, among other things:

- Comprehensive analysis and evaluation of stock markets and other financial markets and economic information, including a forecasting perspective

- Assessment of clients' assets and circumstances to define investment needs and risk tolerance

- Design of suitable investment strategies based on needs and objectives

- Application of different investment techniques to implement investment strategies

- Portfolio construction and structuring

- Trading in financial instruments and execution of transactions

The investment process

In the investment process, EAMs increasingly rely on digital tools for portfolio optimization, performance monitoring, analysis of financial instruments, and risk analysis with which they can implement their convictions. This allows them to document the investment process and ensure risk compliance.

The interaction between the client and EAM is also digitally supported, and in many cases, clients can directly access all relevant information to overview their assets.

Additional services

Since EAMs compete with wealth managers to a certain extent, they regularly collaborate with lawyers, tax experts, insurance advisors, and other specialists to add client value in addition to their core services.

The custodian bank

The quality and range of the services and products offered play a decisive role in selecting the custodian bank. The custodian technology platform with real-time product and market data and direct access to global markets is of great importance.

Broad collaborations

EAMs usually work with several custodians and expect preferential pricing, state-of-the-art technical capabilities, specialist and proactive support, transactions in all asset classes, risk management capabilities, and complete and accurate reporting in a highly secure environment.

Process and workflow integration

Many custodians integrate EAM processes and workflows to enable a seamless client experience. With that, the custodian gets the chance to offer additional services for administration, execution, brokerage, complex financing, wealth planning, wealth structuring, tax reporting, insurance, investment banking, research, ESG and impact investing, and private equity.

External asset management fee models

Here you can expect a broad range of options.

Assets under management fees

Usually, pricing depends on the assets under management. It's a well-known model, although it doesn't capture the complexity of the mandate and the performance. On the flip side, you will know the costs from the outset, it's straightforward, and you control the costs.

Performance-based compensation

Performance-based fees enable greater alignment of interests since the EAM will have skin in the game. However, this pricing model is not widespread in the industry thus far, presumably due to operational challenges and uncertainty of costs and revenues. That's why a combination of assets under management and performance solves the dilemma. One crucial aspect of performance fees is that they can provide a wrong incentive for the EAM to run additional risks for enhanced short-term performance's sake. This point should be transparently treated in fee negotiations. In particular, if your objective is long-term wealth preservation, performance-based compensation may not be a great fit.

Fixed fees

Fixed or all-inclusive fees can be attractive due to their predictability for both clients and EAMs. The most apparent benefit for clients is that they would not suffer higher costs simply because financial markets developed positively. To align interests even more, fixed compensation can be combined with a performance bonus and penalty. For the EAM, this means a stable income and performance impact but without an incentive to take more significant risks. For the client, fees are predictable and still correlate with performance.

Other compensation models

Transaction-based remuneration is not typical since it could result in ongoing portfolio restructuring. Sometimes EAMs charge hourly, although this model requires a clear definition of the value expected from services. However, in the case of a mandate's predominantly advisory component, it could result in a fair arrangement for both parties.

The clients' perspective

According to the EY 2019 Global Wealth Management Research Report, nearly half of discretionary mandates' clients are unhappy with the fees they pay and don't think that they are charged fairly. There is a lack of perceived value and fairness due to low awareness and understanding of fees.

While this is not an EAM specific finding, they must consider clients' demand for transparent and straightforward pricing. Aligning predictable pricing with value as in other industries is the way forward. Alternative pricing models should also provide clarity on hidden costs and uncover the services' underlying value.

Due to their lean structure and flexibility, EAMs can provide personalized compensation solutions to ensure fairness and client satisfaction. Granular and transparent reporting of costs and performance is the baseline for every fee arrangement.

The report confirms that assets under management compensation are still the most common model, but fixed fees and per hours of support methods are the most desired. To meet the demand for alternative pricing models, forward-looking firms develop fee structures that offer clients more options and certainty in a personalized setting.

How to select your external asset manager

The ideal EAM offers a combination of independence, transparency, outstanding performance, and service quality to best align with your interests. Collaboration capabilities with custodians and other service providers, pricing, and process efficiency are other elements to consider in the evaluation process. There should be no conflicts of interest to enable a high-touch and high-quality service level from the outset.

A structured selection process

It would be best to clarify your objectives and investment strategy to identify a specialized EAM delivering personalization.

Specialized advisors and their standardized beauty contests are a more recent offering to assist in the EAM selection. In most cases, they are independent with no affiliation to EAMs and custodians. With an objective and evident service provider selection process, they achieve cost-efficiency, transparency and avoid conflicts of interest. They also offer regular performance and cost reporting and monitor investment strategies.

Since clients typically look for a long-term relationship with an EAM, it may be worth retaining an independent advisor for the selection process. If clients want to work with several specialized niche EAMs, this selection approach can also add value.

External asset manager vs. family office

Here the concept delineations are blurred since some EAMs also act under the label multi family office, sometimes presumably for marketing purposes.

Multi family offices

In its purest form, a multi family office sources the best asset managers and solutions in the market and monitors them to report independently to its clients. It stands for unbiased evaluations and objective decisions. If multi-family offices offer asset management services, for the most part, they overlap with EAMs.

Conflicts of interest

Things get tricky if the multi family office acts as one of the asset managers and performs monitoring. That's when potential conflicts of interest enter the scene, and you may not receive the promoted independent oversight. Thus, it's essential to evaluate the individual services rather than relying on labels.

Single family offices

A single family office is a service entity for one specific family. Since it is tailored to the individual family's needs, there is no unified standard for size, governance, and service levels.

In general, we don't advocate that the single family office performs asset management for the simple reason that external managers can be replaced if performance is not as expected. In our view, the single family office should perform asset management only if, for example, specific expertise and experience in an asset class exist, such as real estate or private equity.

For all other asset classes, sourcing and monitoring the best external managers in the market will provide the most value to the family.

EAM regulation

Financial regulation is an essential factor to ensure consumer protection and protection of the financial market. In Switzerland, EAMs must be licensed by FINMA, the Financial Market Supervisory Authority, and controlled by a supervisory organization.

Regulatory requirements

EAMs have to guarantee an irreproachable business activity, enjoy a good reputation and have the required professional qualifications. They establish appropriate rules for corporate governance and organization to fulfill their legal obligations. In particular, risks must be measured, managed, and monitored within a practical risk management and control framework.

Transparency

Clients can expect a high level of transparency about services, costs, risks, and conflicts of interest. Investments are subject to a suitability and appropriateness check within the limits of the individual risk profile. EAMs can only receive retrocessions from third parties if they inform their clients and clients don't claim them or pass them on to clients. In addition, all retrocession arrangements have to be disclosed as conflicts of interest.

Wealth owners' benefits

The global trend of increasing regulatory requirements is good news for wealth owners. It lays down the highest standards for EAMs' obligation of acting in their clients' best interest. Regulation strongly influences processes and the organization for enhanced service quality and delivery. And for EAMs, strict regulation represents a seal of approval for their activities under established industry standards and the required professionalism.

Final thoughts on external asset management

With an EAM, you can build a personal, trusted, and long-term relationship. The continuity of such a relationship implies a comprehensive understanding of your needs. EAMs develop their business for the long term, so you usually don't have to expect much fluctuation. They are often experienced former private and investment bankers with a sound understanding of the industry and limited interest in returning to the corporate world.

Individualized solutions

Compared to competing offers, the client relationship is more individualized with an independent asset manager. In general terms, they are intensely focused on the client through specialization to provide personal advice and tailored solutions.

Fast decisions

Decision-making processes are usually short to be able to react quickly to changing market conditions. In many cases, clients put risks at the center of their investments, and with an EAM, they want to obtain more clarity on the rationale of investment decisions and their performance impact.

Alignment of interests

Independence in product choice meets customers' needs, particularly when the EAM does not offer its own products. As a business, EAMs have an incentive to influence their company sustainably and positively and thus a corresponding motivation to satisfy their clients.

The clients' benefits

For the client, all of these elements can lead to a personalized, flexible, diversified service offering that reduces the risk of conflicts of interest to a minimum.

FREQUENTLY ASKED QUESTIONS

What are the benefits of External Asset Management?

External Asset Managers (EAMs) offer several benefits to wealth owners.

One of the primary advantages is the high degree of independence they provide. Unlike traditional banks or wealth management firms, EAMs are not tied to specific products or services.

This independence allows them to offer various options from different custodians, leading to a more personalized and less standardized advisory process.

EAMs frequently also maintain a trusted relationship with their clients, understanding their unique financial needs and providing tailored advice on investment requirements, objectives, and strategies.

They offer comprehensive financial advice and manage clients' assets following defined investment strategies.

How does the business model of an External Asset Manager work?

The business model of an EAM involves three contractual relationships.

The first is the investment advisory or asset management agreement between the client and the EAM.

The second is the custody agreement between the client and the custodian, usually a licensed bank.

The third is a cooperation agreement between the EAM and the custodian.

While the EAM manages the client's assets and makes investment decisions within the agreed investment strategy, the custodian holds the assets and provides additional services.

This triangular relationship ensures optimal results, with the partnership between the EAM and the custodian being a critical factor for quality and client satisfaction.

The EAM model aligns interests for tailored and flexible solutions, providing individual services and continuity without depending too much on a single service provider.

What should you consider when selecting an External Asset Manager?

When selecting an EAM, several factors should be considered. These include the EAM's independence, transparency, performance, and service quality.

Evaluating their collaboration capabilities with custodians and other service providers, pricing structure, and process efficiency is also essential. Avoiding conflicts of interest is crucial for a high-quality service level.

A structured selection process can help identify a specialized EAM that delivers personalization.

Independent advisors can assist in the EAM selection, offering an objective and transparent service provider selection process, regular performance and cost reporting, and monitoring of investment strategies.

This approach ensures a long-term, trusted relationship with the EAM, providing personalized, flexible, and diversified service offerings.

Updated 27-07-2023

Contact us to schedule a free consultation to learn more about getting the most value from your individualized wealth management solutions.