Have you heard about a Lex Chaplin? Why should you? There has never been such a law. However, the term has been used since the 1950s when Charlie Chaplin moved to the Swiss Canton of Vaud, presumably under a lump sum taxation regime.

Such a rule was not new. In 1862, the Canton of Vaud introduced specific tax arrangements for foreigners who did not follow a gainful activity in Switzerland, mainly because they retired but were of economic or touristic interest. Chaplin lived in Corsier Sur Vevey for 25 years until his death in 1977.

Since Chaplin arrived in Switzerland, other cantons have implemented lump sum taxation regimes, and still today, it attracts foreign celebrities and wealth owners to move to Switzerland.

There has always been a political debate around such taxation arrangements, not only in foreign countries that lost substantial taxpayers but also in Switzerland. Some cantons such as Zurich, Basel (Stadt and Landschaft), and Schaffhausen do not offer them anymore after referendums or legislative initiatives.

Tax competition is an international phenomenon, and in Switzerland, it is also happening between cantons. In Europe, several countries have a preferential tax regime to attract foreign nationals, and most of them exempt foreign income from taxation to various degrees.

While lump sum taxation in Switzerland is not among the cheapest global residence options competing over wealthy taxpayers, it is one of the most attractive for several reasons. This post will cover the main benefits and things to consider when it comes to this topic.

The Swiss tax system

In Switzerland, taxes are levied by the Confederation, the cantons, and communes. However, people have the final say on taxes since tax laws are subject to a referendum as any other law that poses an obligation on citizens.

The public debt ratio to GDP is around 30% and an excellent foundation for maintaining the medium-long term's current taxation level. Internal tax competition between cantons and communes promotes economic growth and investments and fosters the public administration's efficiency.

According to the Swiss taxman, both direct and indirect taxes are not among the highest by international standards, and we agree with that statement.

What is lump sum taxation?

Essentially lump-sum taxation is a taxation methodology based on the taxpayer and dependent family members' annual worldwide living costs instead of taxation on effective income and wealth. This taxable base is subject to ordinary federal and cantonal income and wealth taxes at applicable rates.

So what's the benefit? Lump sum taxation provides a predictable taxable base and attractive tax results if the taxpayer's foreign income is significantly higher than the individual cost of living. Furthermore, there are no surprises since the tax authorities' advance ruling typically covers the relevant amounts.

Who can benefit from lump sum taxation?

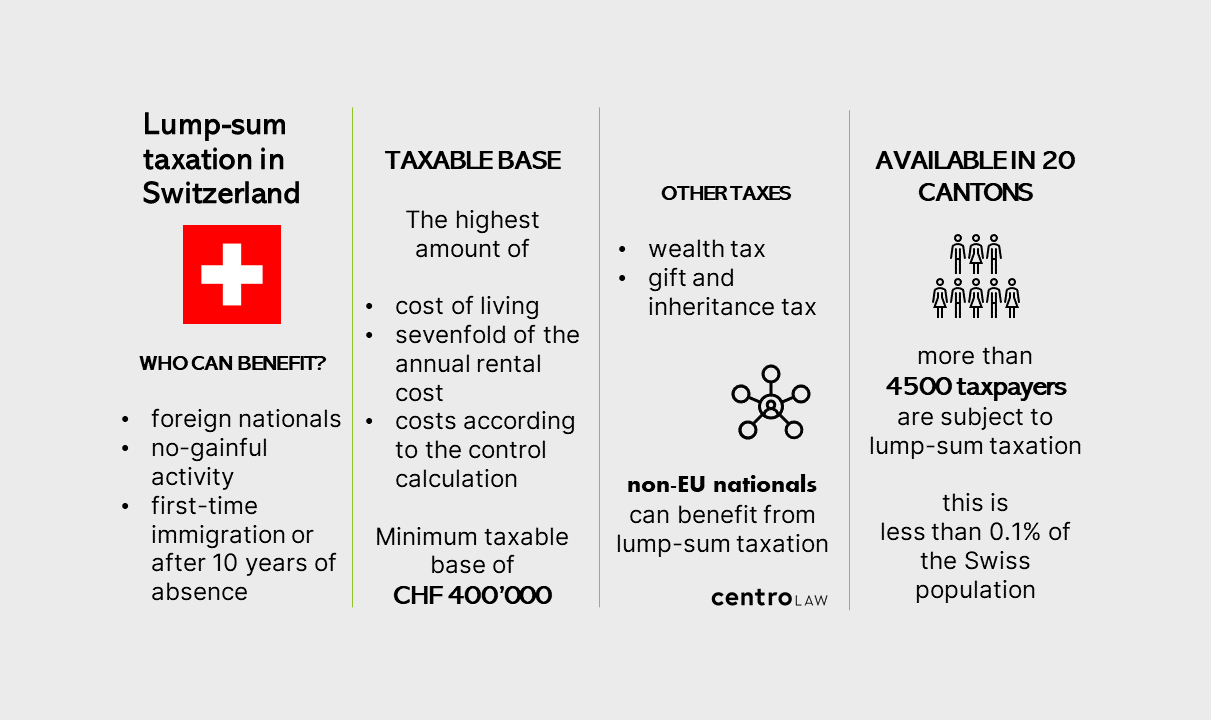

Foreign nationals who become subject to unlimited taxation in Switzerland for the first time or after a ten-year absence can benefit from lump-sum tax if they don't perform any gainful activities in Switzerland.

If a couple intends to immigrate, both need to fulfill these requirements. Unlimited tax liability includes establishing a Swiss domicile or residency.

Gainful activity

The taxpayer cannot exercise any gainful activity in the sense of a full or part-time occupation on Swiss territory irrespective of local or foreign income. As active entrepreneurs may not meet the requirements, we recommend following a restrictive interpretation of this subjective criterion and avoid the performance of any independent or employment work on Swiss soil.

Why Formula 1 drivers live in Switzerland

In particular, artists, scientists, inventors, athletes, and board members lack the subjective criterion if their workplace is considered Switzerland and risk becoming subject to ordinary taxation. However, several Formula 1 drivers enjoy Swiss lump sum taxation benefits since, in the absence of a Grand Prix in Switzerland, they perform their work exclusively outside Swiss territory.

Commercial securities trading

Taxpayers can manage their private wealth in Switzerland but should be aware that short holding periods, large transaction volumes, leveraged and derivatives trading could be considered commercial securities trading under certain circumstances. If the activity is performed abroad, the distinction between private wealth management and commercial securities trading is irrelevant.

An individual assessment of the particular circumstances should lead to a concrete understanding of how foreign gainful activities can be performed without harming the lump-sum tax arrangement.

Tax rulings

If this baseline sounds risky to you, the good news is that Switzerland has a long tradition of advance tax rulings, and tax authorities have to act in good faith towards the taxpayer. You can expect the tax authorities' service mindset, although it may vary from canton to canton.

Before requesting a tax ruling, you can discuss individual circumstances with the tax authorities to obtain certainty and predictability. If the taxpayer is missing one or both of the subjective criteria during the following taxable periods, e.g., due to taking on Swiss nationality or performing a gainful activity in Switzerland, ordinary taxation will become applicable.

The taxable base

Three factors determine the taxable base: the global cost of living, the rent or rental value of the taxpayer's Swiss real estate, and Swiss sources' income.

The cost of living

The international costs of living of the taxpayer and all dependent family members encompass everything you could imagine. This includes

- the costs for food, beverage, and clothing

- the costs for lodging and accommodation (incl. utilities, heating, cleaning, garden maintenance, mortgage interests)

- the total expenses for service personnel (including board, lodging, other wages)

- the expenses for education, culture, sports, and entertainment

- the costs of maintaining or pursuing elaborate hobbies (riding horses, motorsports, etc.)

- expenses for travel, holidays, short stays, etc.

- the cost of maintaining, insuring, and operating cars, motorboats, yachts, and aircrafts

- the financing costs (e.g., for land ownership)

- other costs of living, incl. direct taxes and social security contributions

- and any other expense category.

The sum of these costs corresponds to the taxable base of at least CHF 400'000 subject to ordinary tax as long as the amount is higher than the Swiss rental costs or Swiss sources' income.

The rental costs

Since the effective cost of living may be challenging to assess, there is an alternative method to determine the taxable base.

The Swiss rental cost is calculated per household and corresponds to the sevenfold of the taxpayer's real estate's yearly rent or rental value if the taxpayer owns the real estate.

The threefold cost of yearly lodging and catering is the taxable base for other taxpayers without an owned or rented home and who prefer living in a hotel.

The control calculation

Finally, Swiss sources' income and foreign source income for which a double tax treaty benefit has been claimed need to be calculated. This so-called control calculation includes income and wealth from movable and immovable assets in Switzerland (income from Swiss real estate, Swiss financial investments, Swiss intellectual property, and Swiss pensions) and foreign source revenue where the taxpayer claims the application of double tax treaty relief on foreign taxation.

The income and wealth tax calculated on the factors above is compared with the tax amount that would result from the ordinary taxation of domestic income and wealth and foreign income subject to double tax treaty benefits.

Modified lump sum taxation

The double tax treaties with Belgium, Germany, France, Italy, Norway, Canada, Austria, and the USA provide specific rules to include foreign source income in the Swiss control calculation to obtain treaty benefits.

Thus, all income from such countries must be included in the control calculation to claim treaty benefits. This specific situation is called modified lump-sum taxation, and with this approach, income from such countries is considered subject to ordinary taxation, and the taxpayer can claim treaty benefits.

With the above, you have three factors for the taxable base, and the highest amount will be taken by the tax authorities to apply income tax at ordinary rates.

For federal tax purposes, a minimum tax base of CHF 400'000 is required. Since the taxable base determination is not straightforward, cantons have defined specific minimum amounts for income and wealth tax calculation.

Again, the Swiss taxpayer is the tax authorities' customer. The best approach is to discuss details with the tax authorities and have the common understanding confirmed in a tax ruling.

Which other taxes are due?

Wealth tax

In addition to income tax at a federal and cantonal level, cantons also levy wealth tax.

How is wealth tax calculated? In most cases, the tax base for income tax calculated as outlined above will be multiplied by 20. Thus, if the taxable income is CHF 500'000, the taxable wealth will be CHF 10 million.

Inheritance tax

The unlimited tax liability includes gift and inheritance taxes levied by the cantons. As there is tax competition between them, most cantons provide exemptions for spouses and children. Inheritance tax planning arrangements can be discussed with the tax authorities and confirmed in a tax ruling.

The Canton Schwyz does not levy gift and inheritance taxes at all, and the Canton of Lucerne is only taxing gifts within the last five years before a person's death.

Some cantons have specific provisions for lump-sum taxpayers which need to be considered.

Social security contributions

Lump-sum taxpayers are subject to social security contributions in Switzerland. The amount depends on wealth and foreign employments and may reach a yearly maximum of CHF 23'900.

Other taxes

Dividends paid from a Swiss source are subject to withholding tax of 35% that can be claimed for refund or credited against Swiss income tax by lump-sum taxpayers.

While private capital gains on movable property are usually tax-exempt, capital gains on real estate are subject to real estate capital gains tax.

Pre-immigration planning

Before moving to Switzerland under the lump-sum taxation regime, a comprehensive review of the taxpayer's wealth and wealth planning structures is essential. It's an ideal moment to revisit your overall wealth planning strategy.

The investment portfolio

Since income from Swiss sources and foreign source revenue where the taxpayer claims the application of double tax treaty relief on foreign taxation are decisive factors of the control calculation, it may be required to restructure the investment portfolio.

Trusts for wealth and estate planning

Trusts are popular estate planning and asset protection vehicles that Switzerland recognizes. If the settlor of an irrevocable discretionary trust is domiciled abroad at the time of establishment, the trust assets cannot be attributed to either the settlor or the beneficiary. Such trusts are usually also non-transparent for inheritance taxes and do not form part of the taxable estate.

The cantons levy gift and inheritance taxes, and the treatment of trusts should be confirmed in the lump-sum tax ruling. With that, you obtain security that the assets under the trust are separate assets for wealth, income tax, and inheritance tax purposes, forming neither part of the taxable wealth and income nor part of the estate.

Revocable trusts are transparent for tax purposes and should also be covered in the tax ruling to ensure the predictable application of gift and inheritance taxes.

Wills

Reviewing and redrafting an existing will is also recommended to ensure it fits into the Swiss legal environment. For married taxpayers, a review of the marital regime is advisable.

Cross-border taxation

Finally, you should also assess the eventual tax consequences in your current country of residence when relocating to Switzerland. Tail provisions, where emigrants remain subject to their home country's inheritance and gift taxes for some years, are one example of exit taxation.

Residence permits

Although almost 25% of the Swiss population are foreign nationals, immigration to Switzerland is subject to restrictions.

While EU nationals with sufficient financial means can benefit from persons' free movement, non-EU citizens need to fulfill an economic or fiscal interest to obtain a residence permit if they don't have a close relation to Switzerland.

Thus, they are subject to higher minimum tax base thresholds, such as CHF 825'000 in the canton Geneva and CHF 1 Mio in the cantons of Zug and Vaud. Still, lump sum taxation remains the desired way for non-EU nationals to take residence in Switzerland.

The process

As always, each tax situation requires individual evaluation. After performing the above calculations and discussing all details with the tax authorities, they need to be provided with all relevant information and the request for a tax ruling on the taxable income and wealth.

With such a verdict obtained, you can then request a residence permit. From experience, we would say that the entire process takes around two months.

Conclusion on lump sum taxation in Switzerland

While not among the cheapest global residence options, Swiss lump sum taxation has a long tradition and comes with certainty and predictability that other newcomers in the field may not be able to offer.

Apart from the required calculations, the evaluation of a residence under lump-sum taxation in Switzerland should focus on gainful activities' circumstances since there are crucial restrictions, particularly for entrepreneurs.

Pre-immigration planning should further cover wealth structuring and the impact of estate and inheritance taxes. All relevant aspects can be covered in discussions with the tax authorities and the specific tax ruling to ensure clarity and predictability.

With that, you can make the most of your residence in a regularly top-ranking place among the global countries with the highest quality of living.

FREQUENTLY ASKED QUESTIONS

What is lump sum taxation in Switzerland?

Lump-sum taxation in Switzerland is a unique taxation methodology that bases the tax on the annual worldwide living costs of the taxpayer and their dependent family members rather than their actual income and wealth.

This approach provides a predictable taxable base and can result in attractive tax outcomes, especially if the taxpayer's foreign income significantly exceeds their cost of living.

The primary beneficiaries of this system are foreign nationals who become subject to unlimited taxation in Switzerland for the first time or after a ten-year absence, provided they don't perform any gainful activities in Switzerland.

The system offers significant advantages for those who meet the criteria, providing fiscal predictability and stability.

How is the taxable base determined under lump sum taxation?

The taxable base under lump sum taxation is determined by three main factors: the global cost of living, the rent or rental value of the taxpayer's Swiss real estate, and income from Swiss sources.

The global cost of living is a comprehensive measure that includes all conceivable expenses, such as food, clothing, accommodation, education, travel, and other living costs.

The Swiss rental cost is calculated per household and corresponds to seven times the yearly rent or rental value of the taxpayer's real estate.

Finally, income from Swiss sources and foreign source income for which a double tax treaty benefit has been claimed are also considered.

The highest amount among these three factors will be taken by the tax authorities to apply income tax at ordinary rates, ensuring a fair and balanced approach to taxation.

What are the other taxes due under lump sum taxation?

In addition to income tax at a federal and cantonal level, cantons also levy a wealth tax. The tax base for income tax, calculated as outlined above, will be multiplied by 20 to determine the taxable wealth.

The unlimited tax liability also includes gift and inheritance taxes levied by the cantons. However, most cantons provide exemptions for spouses and children.

Lump-sum taxpayers are also subject to social security contributions in Switzerland.

Finally, dividends paid from a Swiss source are subject to a withholding tax of 35% that can be claimed for refund or credited against Swiss income tax.

Updated 27-07-2023

Contact us to schedule a free consultation to learn more about the available relocation options and how we can assist you in obtaining residence in Switzerland.