Wealth planning is about implementing the right solutions to grow, preserve and transfer your wealth.

It goes beyond traditional financial planning by including the areas of wealth structuring, asset protection, and estate planning.

Let's assume you spent some time with your wealth manager and maybe lawyer and developed a plan on how to grow, preserve and transfer wealth.

You have a few wealth planning tools in place, things look settled, and you feel comfortable with your overall situation.

That's great but did you ever challenge your setup?

Did you consider changes in circumstances?

Do you have an ongoing review cycle to stress test? Is your family informed and comfortable with it?

If this has not been on your radar, your wealth plan may not reach its full potential.

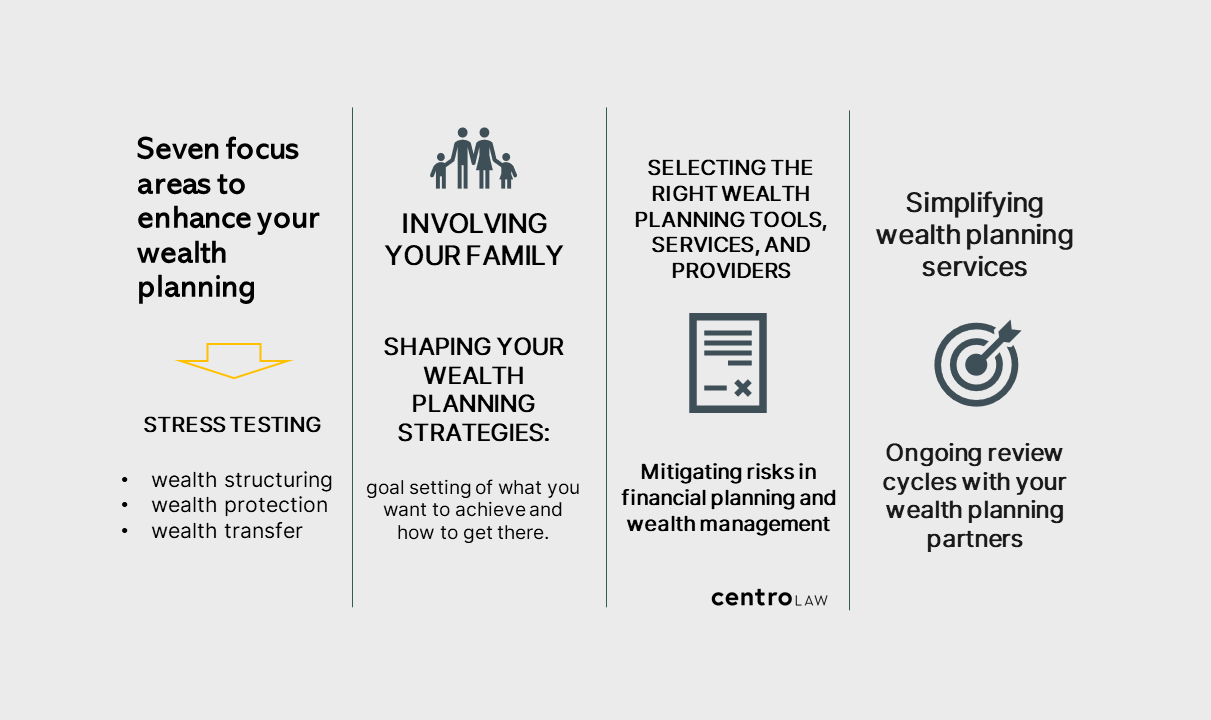

Read on to identify the areas to enhance your wealth planning and make all the difference.

Stress testing your wealth planning solutions

The best way to understand whether your wealth planning solutions fit your purpose is to assess the status quo and stress test it.

Based on a comprehensive overview of your wealth and wealth planning tools, you can determine the impact of life events and changing circumstances on your existing wealth plan.

The target is to identify deviations from intended goals and uncover blind spots.

In our experience, the following three main areas reveal most of the risks and opportunities.

There are many parameters to stress test, and the below questions are just a few to evaluate the quality of your wealth planning solutions.

Wealth structuring

Are all assets structured in a way that they fit into the overall strategy?

Is there a sufficient level of asset consolidation to enable straightforward administration?

Is the wealth structuring tax-efficient?

Wealth protection

Is there a specific risk exposure due to potential liabilities?

How are assets protected against lawsuits, creditors, and divorces?

Are there risk mitigation measures against political, cybersecurity, and other risks?

Wealth transfer

Do your wealth planning solutions allow for a smooth and predictable transfer of wealth?

Are the tools flexible enough to adapt to new situations?

Does your setup consider succession procedures in multi-jurisdictional scenarios?

Challenging the status quo against plausible and exceptional events will reveal eventual vulnerabilities and areas for improvement.

You can use a historical approach and find inspiration in media reports about wealth owners that had to go through similar events in the past.

The analytical analysis will determine your wealth planning's strength to face unfavorable conditions by assessing each of the above areas individually.

Understanding your exposure to risks allows you to improve risk management and reduce uncertainty.

Involving your family in the wealth planning process

Wealth planning is an ongoing process rather than a one-off exercise.

It would be best to involve your family to enhance the wealth planning process and prepare them for generational wealth transfer.

You will learn more about their understanding of safety, stability, and overall quality of life.

And you will enforce your wealth plan with their buy-in to preserve wealth within the family.

Here's a short step guide on how you can approach their involvement:

Understanding shared values

Values guide us and determine our demands on our environment.

Shared values provide a better understanding within a group and offer a common denominator to achieve common goals.

Discussing values concerning a family, its wealth, business, and position within its community can strengthen communication and cohesion.

Values make it possible for a family to have measurable standards by which members can orient themselves.

They provide identity and allow for individual interpretations that fit into the community.

Defining the purpose of wealth

A family's mission addresses fundamental questions about why it should exist as a unit and what it can achieve together.

It determines which principles it wants to follow without restricting individual ways of living based on its values.

It is not about polished corporate formulations but about a meaningful dialog on how a family unit can meet life's challenges.

Wealth is a part of this, and families who actively address their relationships and position within society will clarify the meaning of their wealth for the group, the individual, and the community.

The family will develop a generational guide if the arc is drawn from the present to the future.

This includes a view of the desired future and how wealth can be used wisely to achieve it.

Enhancing communication with family governance

The focus here is less on rigid rules and decision-making and more on a regulated framework for communication within a family.

Regular exchanges about experiences, expectations, and obstacles strengthen trust in each other and guide all family members on the path to a shared vision.

An open and transparent discussion enables a long-term orientation in which older generations can pass on their experience to younger ones.

This prepares the younger generation for wealth transition and future success.

Shaping your wealth planning strategies

Wealth planning strategies are ideally based on goal setting of what you want to achieve and how to get there.

As such, they need to be customized to your circumstances and cover the wealth lifecycles of growth, preservation, and transfer.

It would be best to develop an overarching strategy for all arrangements to avoid things getting overlooked and lost in a siloed approach.

You can achieve this with a value proposition to clarify the essentials and understand where each component fits into the big picture.

The value proposition will summarize the benefits of your wealth planning strategy and why you should stick to it in the long haul.

In our experience, a core and satellite approach delivers practical and consistent results in the strategy's execution.

While the core arrangement ensures lasting and robust coverage, the satellite part allows for flexibility to adapt to changes.

There's no need to complicate things with such a game plan since clarity on objectives and execution will drive the process.

If decisions over time are taken in light of specific goals and the defined approach, you'll enhance your strategy with every review cycle towards your ideal outcome.

Selecting the right wealth planning tools, services, and providers

Wealth planning tools are essential to implement a strategy of growing, preserving, and transferring wealth.

These can be trusts, foundations, life insurance policies, corporate structures, and family investment companies, to name a few.

Next to selecting the right combination of tools, assess which services and providers you need.

Single family offices and multi family offices are wealth management service entities that deliver tailored solutions and leverage an external provider ecosystem.

They act as a one-stop-shop, although in our view, their main focus should be strategic asset allocation, risk management, and accounting and reporting.

Another option is to work with an external asset manager. They are independent of custodian banks and manage your assets and investments, offering a broad range of products and services.

Finally, you can work with a wealth manager and integrate other providers such as trustees and life insurance companies delivering the required wealth planning tools and services.

For most sophisticated estate planning, private trust companies offer another opportunity to perform services with your ecosystem.

It would help if you also aimed for a certain level of diversification to avoid dependencies and run a concentration risk.

In any event, services need to be aligned and streamlined for connected results for all possible scenarios.

Mitigating risks in financial planning and wealth management

Financial planning and wealth management risk mitigation can further enhance your wealth planning based on a thorough stress test.

Whatever service you receive, talk to your providers about dealing with risk management.

Each aspect should be reviewed from a risk perspective to prepare for unexpected events.

In financial planning, challenging goals against the assumptions of the envisaged strategy will reveal current and emerging risks to tackle.

Has your situation been appropriately assessed? Are forecasts realistic? Is the financial planning methodology corresponding to your life expectations?

Diversifying wealth management within providers will enable different views and approaches and reduce dependencies.

There's no single source of truth in wealth planning; that's why a variety of services and providers helps provide various perspectives on mitigating risks.

Understanding the sources of risk and categorizing them will guide you towards a robust risk management framework.

For financial planning and wealth management, leveraging broad and specialized views will allow you to tap into a wide experience to mitigate the risks associated with your specific situation.

Simplifying wealth planning services

The complexity of wealth planning services is increasing on several fronts: families are multi-jurisdictional and multigenerational.

As an example, how and where you want to spend your time may not correspond to the vision of other family members.

This adds a new dimension from a legal, tax, and financial perspective. Therefore, in our view, simplicity is essential in wealth planning and structuring.

Your arrangements need to hold firm in several jurisdictions as beneficiaries may move residence and change life plans.

Complicated and technically overloaded solutions and services are rarely understood in several jurisdictions, and you risk unintended outcomes.

Keeping things simple within the above-outlined core arrangement ensures effectiveness in multiple jurisdictions and allows you to adapt if things change.

Ongoing review cycles with your wealth planning partners

Regular jurisdictional reviews lead to a cross-border alignment of the entire wealth planning framework depending on your situation.

Also, the shift from wealth generation to wealth preservation and transfer requires a different method and should not be covered by the same techniques.

Finally, it would help if you always planned for a smooth wealth transfer that can occur at any time. Here you could target to reduce financial and emotional pressure on surviving family members.

With such a review focus, you'll achieve a total wealth picture of the entire family and a standard of how decisions are taking overtime to contribute to well-rounded strategies.

Your wealth planning partners should collaborate and communicate with each other in ongoing reviews to ensure the coherence of your wealth planning framework.

If they overcome silos, their services and solutions will enhance each other and cover the entire wealth life cycle.

For example, trustees and life insurance companies can achieve great results by combining their services rather than delivering them in an isolated fashion.

We believe in the power of the process to prepare for unforeseen events and that the ongoing dialog with and between advisors and services providers will shape your arrangement to address complexities and crises.

Summing up on enhancing your wealth planning

All the above areas contribute to a comprehensive wealth planning framework. As we said, wealth planning is no one-off exercise but an ongoing process.

That's why stress testing and ongoing reviews are essential to ensure your arrangement corresponds to your current situation.

Involving your family in defining a wealth planning strategy is another crucial element of all-embracing solutions to grow, preserve and transfer wealth.

With the flow of information and communication between family members, you'll create a shared understanding of the purpose of your family's wealth.

When selecting the required wealth planning tools and providers, we advise aiming for simplicity and diversification.

Remember, the more complex, the more simple.

With that, well-thought legal structuring will prepare the next generation for wealth transfer and protect wealth from various risks.

Planning ahead before any unexpected events materialize will set up your wealth plan for success now and in the future.

Finally, clarity on goals and consistently reviewed wealth planning strategies supported by wisely selected tools ultimately help protect wealth and keep it in the family for generations.

FREQUENTLY ASKED QUESTIONS

What is the importance of stress testing in wealth planning?

Stress testing is a critical component of wealth planning. It involves a comprehensive evaluation of your current wealth status and wealth planning tools, assessing how they might be impacted by life events and changing circumstances.

The goal is to identify deviations from intended goals and uncover potential blind spots. This process often reveals risks and opportunities in wealth structuring, protection, and transfer.

By challenging the status quo against both plausible and exceptional events, you can identify potential vulnerabilities and areas for improvement.

Understanding your risk exposure allows you to improve risk management and reduce uncertainty.

This, in turn, enhances your overall wealth planning, ensuring that your wealth is safeguarded against unforeseen circumstances and is aligned with your long-term financial goals.

How can involving your family enhance the wealth planning process?

Involving your family in the wealth planning process can significantly enhance its effectiveness.

Wealth planning is not a one-off exercise but an ongoing process that requires the participation and understanding of all family members.

By involving your family, you can better understand shared values and the purpose of wealth within the family.

Regular discussions about experiences, expectations, and obstacles can strengthen trust and guide all family members toward a shared vision.

This open and transparent dialogue enables a long-term orientation in which older generations can pass on their experience to younger ones.

This prepares the younger generation for wealth transition and future success. It strengthens the wealth planning process, ensuring it is robust, inclusive, and aligned with the family's vision and goals.

What are strategies for simplifying wealth planning services?

As families become more multi-jurisdictional and multigenerational, the complexity of wealth planning services is increasing.

Therefore, simplicity is essential in wealth planning and structuring. Wealth arrangements must be robust across multiple jurisdictions, as beneficiaries may change residences and life plans.

Overly complicated and technically complex solutions are rarely understood in several jurisdictions, leading to potential unintended outcomes.

Keeping things simple within the core arrangement ensures effectiveness in multiple jurisdictions and allows adaptability if circumstances change.

Regular jurisdictional reviews can lead to a cross-border alignment of the entire wealth planning framework, contributing to simplifying wealth planning services.

This approach ensures that your wealth planning is clear, understandable, and practical, regardless of the complexity of your family's situation.

Updated 28-07-2023