Family office human capital

The most critical asset of every single family office is finding the right people to integrate into the individual structure.

Suppose your single family office has a clear mission and vision, value proposition, and specified underlying values.

In that case, the first step is to define the staff’s required skills, experience, and mindset to preserve and develop them further.

Beyond skills and expertise, you should place a specific focus on intangibles such as motivations and emotional intelligence to ensure that the family office’s people share your values and culture and build empathy for your issues and pressures.

The recruiting process

This requires a well designed recruiting process and an in-depth understanding of how the job has to be done.

Look for people who communicate on an equal footing and fit into hierarchies since the single family office exclusively serves the family and needs to develop an autonomous take on risk management, family education, and guidance.

Retention management

The next step is retention management for a stable single family office.

It starts with industry-standard compensation but in a highly competitive market, that will not be enough to retain talent.

Beyond bonus payments, the reward should stand out of the crowd and add value to both the family office and its people.

Constant education offerings and secondments in specialized niche firms such as private equity or sustainability boutiques are good examples and foster an alignment in purpose.

The family office may also consider financing of investments or life insurance for its staff.

However, we don’t believe in golden handcuffs since loyalty and empathy are essential.

You don’t want people who stay with your single family office only in light of the next bonus or because they fear losing their nonvested compensation.

Family office trends in staffing

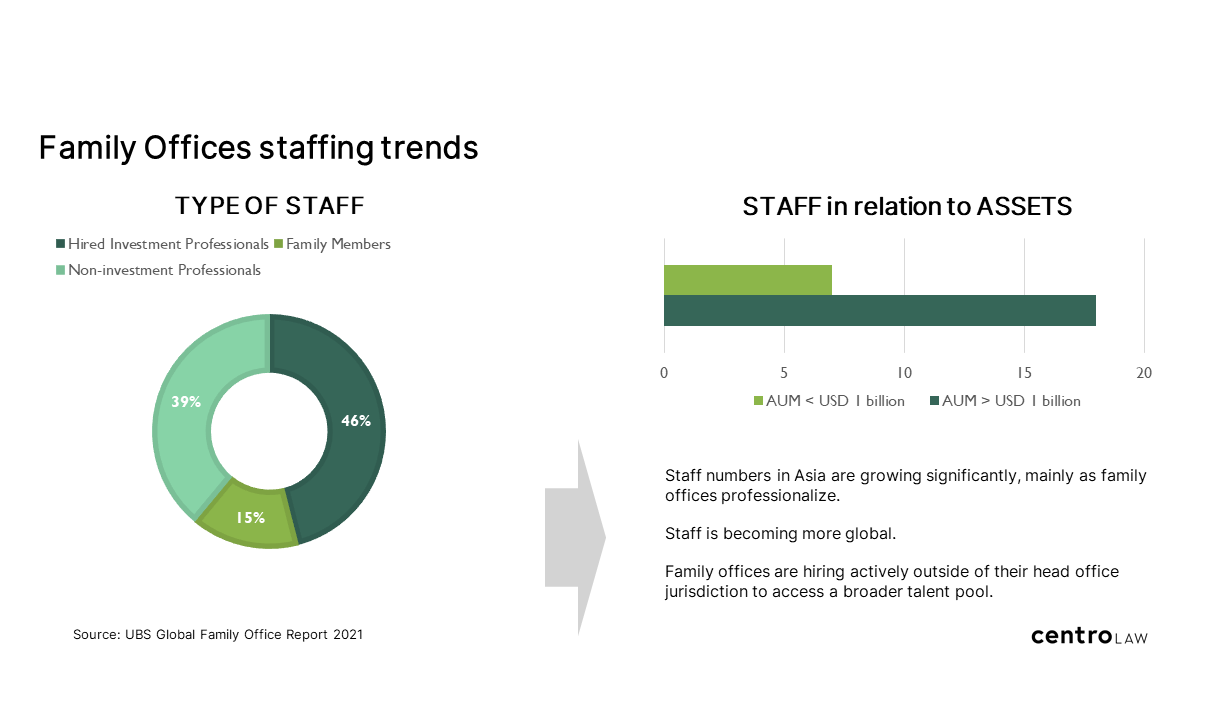

According to the 2021 UBS Family Office Report, 46% of staff are investment professionals, and 39% are non-investment professionals such as operations, legal, and accounting specialists. Family members make up for 15% of staff.

Depending on the assets under management, large family offices employ eighteen people while smaller family offices have seven people on their payroll.

Significant employment growth is happening in Asia, where family offices professionalize. Their staff is becoming more global, and they are actively recruiting in foreign jurisdictions to access broader talent.

There’s heavy demand for top talent and specialized professionals. This fact sometimes even impacts where to set up a family office.

Regarding compensation, bonuses are still the main incentive. However, in the US, more diverse benefits are offered, such as investing alongside the family.

Like other industries, family offices are shifting to a hybrid working environment that offers employees more flexibility and positively impacts their office space costs.