Family offices are the zeitgeist in wealth management. Everyone has or wants one. You can choose from single-family offices that can depend on family and be integrated into the family business or independent from the family business or multi family offices that can be privately owned by various families or by independent third parties.

Either way, there has been exponential growth over the last decade. Which one is better suited for a family depends on many circumstances. Both options come with considerable costs, limited flexibility, and a steady headcounts increase due to regulatory complexity.

This is when a virtual family office changes the game by leveraging technology and virtual collaboration in an agile and multi-disciplinary setup.

The virtual family office structure

Let's have a closer look at the structure of a virtual family office: It's a single family office tailored to the specific needs of the family with a central cockpit to oversee the various building blocks that are variable depending on the challenges.

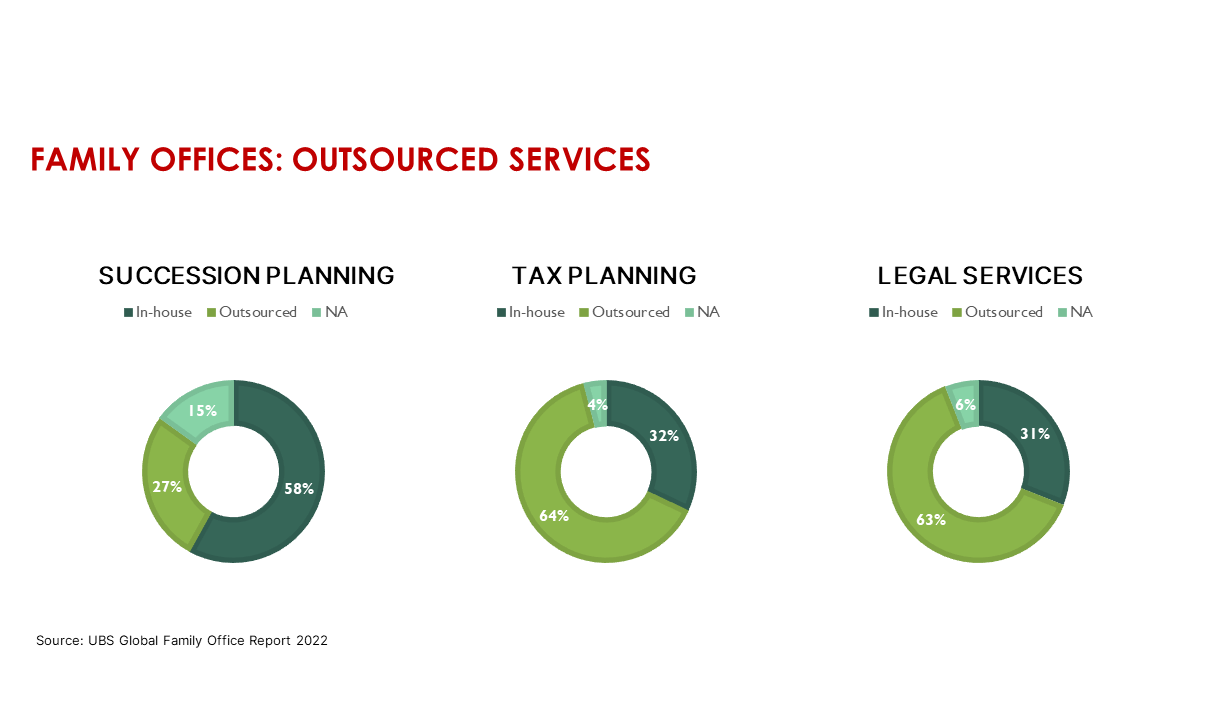

It all starts with an analysis and definition of the core goals to achieve. Let's say a family has defined independent investment management as their prime goal. They then need to clarify which other areas are vital for them, such as wealth preservation, asset protection, succession planning, and estate planning.

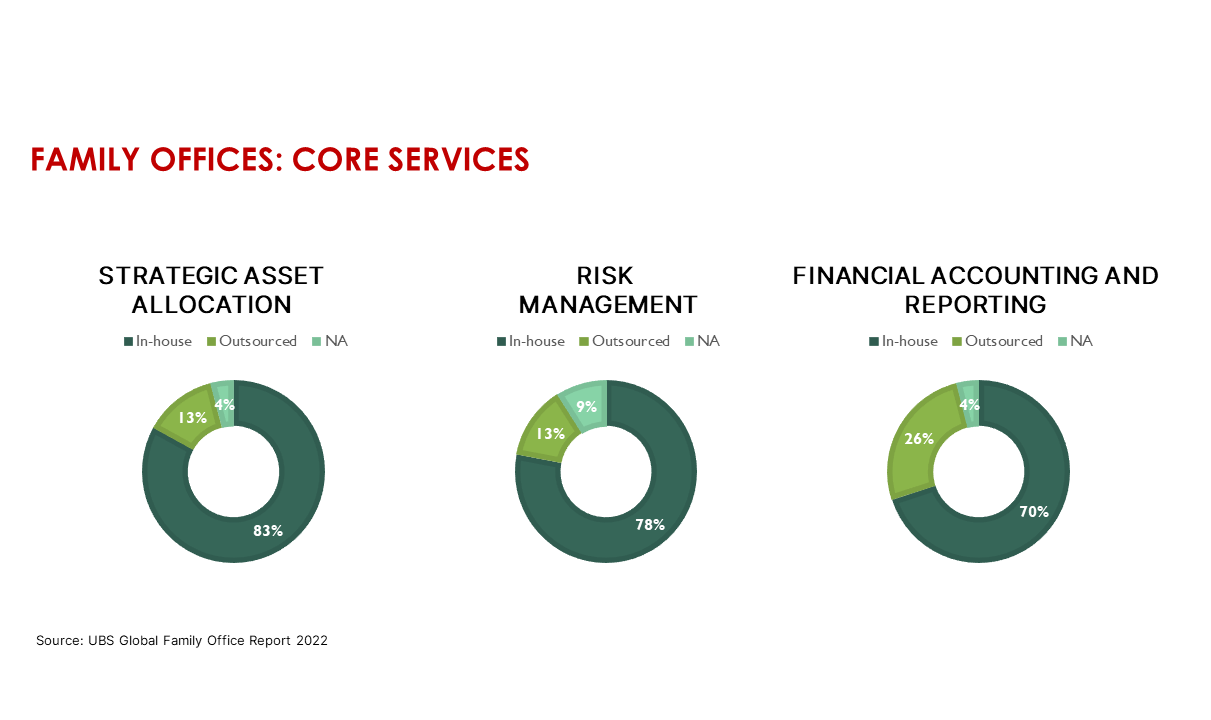

In our experience, a family office performs best in specific, realistic in-house core capabilities and services without getting distracted by trying to cover the broadest service range along the wealth management value chain.

The human context

Another essential point is understanding technology's function in the structural system: It's not building services around technology but leveraging it to satisfy specific family needs. As outlined below, focusing on essential needs in a human context is crucial in a virtual collaborative environment.

A virtual family office is a complex arrangement, and if the design process concentrates on the fundamentals, core services can be delivered effectively, and other competencies can develop over time.

However, before designing the structure itself, the family needs to clarify how approaching wealth in context with values, purpose, and belonging for its long-term preservation.

Family governance

Family governance facilitates complex and challenging conversations in a structured setting and guides family members in integrating into and contributing to the family and, eventually, business network. Again, there is no standard template for that.

However, it's essential to consider the position of all generations involved to achieve the best results to cover the needs of all family members. The definition of values, purpose, roles, and decision-making is crucial in this context.

A written family governance framework and mission statement provide guidance and unity. In particular, cross-jurisdictional families and millennial family members will appreciate virtual family assembly gatherings to exchange information and make decisions.

We advocate for the early involvement of future family leaders, and broad governance consensus and participation. Next-generation leaders should have clarity about succession plans and the requirements to step into leadership roles.

We further recommend transparent and frequent communication; again, technology can facilitate the process. All of these governance elements will shape the "family culture" and foster alignment and commitment to preserving the family wealth over generations.

Succession planning, like in business, is a process, and it's as essential for wealthy families as for businesses.

Virtual family office governance

With the defined family governance framework, the virtual family office and its core building block – in our example, the investment management part – can be designed to integrate technology and an investment team.

It doesn't need to be full-time and in-house since external providers may offer a robust investment process and institutional-level research. We would not even recommend full-time in-house teams for the simple reason that external investment managers can be replaced if performance is not as expected. With a flexible digital platform, it can also be a mix of in-house and external specialists.

The market offers various family office technology solutions tailored to individual requirements. A virtual investment committee with family members and independent specialists alongside a strict investment and due diligence process can save costs and deliver the desired results.

And with a reliable reporting and control framework, adherence to the family's investment strategy can be guaranteed.

A coherent governance framework assures the quality of services and seamless integration of all building blocks in a robust policy and process landscape. Combining technology and leveraging external service providers' expertise in an efficient virtual collaborative environment will lead to excellent results at lower costs.

Due to technology and external advisors and professionals adapting to a new collaboration and predictable pricing model, the family office space is evolving towards platform ecosystems. They enable efficiency, data-based decision-making, real-time oversight and control, and substantial cost reduction.

The virtual family office governance framework defines such an ecosystem's principles, systems, roles, and responsibilities.