You are using an outdated browser. To have the best experience use one of the following browsers:

Stay in the know - the family office and private wealth blog

Insights and News

Guest Series: Exploring fine wine investment opportunities

Investing in wine can be challenging but rewarding. It requires expertise, experience, and dedication ...

The benefits of Liechtenstein foundations

If you're looking for a way to manage your wealth that offers privacy, flexibility, and protection, a ...

A practical guide to moving to Switzerland

Switzerland is well known for its high standard of living, solid and innovative economy, political ...

The importance of estate planning: protecting your wealth and loved ones

It is remarkable how many wealth owners have not arranged their succession.

The reasons may be many, but ...

The things you should know before setting up a family office

Setting up your own family office is a great way to grow, protect and transfer family wealth. But there ...

Estate planning trusts: What, how, and when?

Trusts are essential to estate planning because they allow wealth owners to pass assets to beneficiaries ...

Guest Series: Building lasting and sustainable family office networks

Building a single family office is already challenging but bringing it to life to seize opportunities for ...

Asset classes that require specific attention in your estate planning

Estate planning is complicated enough. However, it gets even more demanding for asset classes such as ...

How to improve your wealth planning arrangements

Wealth planning is about implementing the right solutions to grow, preserve and transfer your wealth.

It ...

What's new in Swiss succession law?

Obviously, there are more exciting topics for a blog post.

However, if you don't get things right in ...

How asset protection safeguards wealth for current and future generations

Wealth is vulnerable in many ways, and some of the most significant threats are lawsuits, divorces, and ...

Guest Series: What to expect from blockchain applications when it comes to wealth management

So far, the wealth management industry has primarily escaped disruption by blockchain technology. ...

Guest Series: Why relying on ESG standards is not enough for sustainable investing

Environmental, Social, and Governance (ESG) has been an incredible success story for recent years and has ...

Where to focus for lasting and effective estate planning solutions

Let's face it: estate planning is not known for its high fun factor.

Nevertheless, it's essential to ...

Turning data into insight on successful family offices

What’s the secret to success? For family offices, success often lies in their investment strategy and ...

Inheritance tax in Switzerland: rules, rates and planning opportunities

It's true what they say; few things are as sure in life as taxes.

Although Swiss taxation is not the ...

How to select a multi family office that aligns with your interests

As a wealth owner, you may find the range of services and solutions offered in the continuously growing ...

Proven governance, ownership, and succession strategies for family businesses

It's a well-known myth and belief that it only takes three generations to lose family wealth completely. ...

How to achieve legitimate wealth protection and preservation

Wealth and asset protection don’t enjoy the best reputation in the eyes of the public. Far too many ...

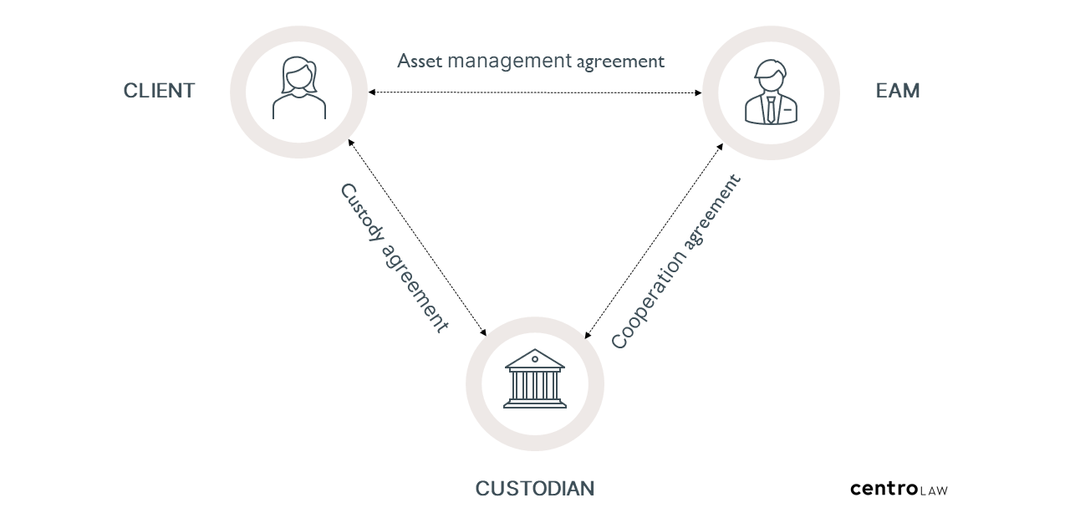

A deep dive into EAM and IAM services

We are looking at external asset management following our recent blog post on asset and wealth management. ...

The private trust company pros and cons

While gaining in popularity, private trust companies (PTCs) are not for everyone. Yes, they can give high ...

What's the difference between wealth management and asset management

There's no doubt that financial terminology can be confusing at times.

Wealth management and asset ...

Guest Series: Wealth planning – a Swedish perspective

According to the 2021 Knight Frank Wealth Report, Sweden is home to more than five thousand Ultra High Net ...

Guest Series: Swiss trustees – a regulatory perspective

With the ongoing consolidation of the trust industry driven by private equity firms, wealth owners often ...

Guest Series: The NFT gold rush - are you missing out on non-fungible tokens investments?

"Invest in what you understand. Just because there is an NFT boom does not mean that every NFT is ...

Guest Series: Climate risk. An emerging financial risk category

Climate change is top of mind for almost the entire world, and climate risk is, in turn, accelerating as a ...

Inheritance taxes: the toolbox for effective planning

No day is without news on new taxes. While we don't claim to predict the future, in light of the taxman's ...

The family office investment policy and process

Family offices are private wealth management service entities that cater to the specific needs of families ...

Guest Series: Business families and storytelling for success

Business families face many challenges, the most critical result from the combination of keeping a family ...

Guest Series: Family business succession planning – the Italian job

Italy is home to more than ten thousand Ultra High Net Worth Individuals. Many entrepreneurs lead family ...

Designing human-centric wealth plans and managing risk

Indulge us a little as we start this post by elaborating on the wealth planning definition: We view ...

Guest Series: THRIVE - a wellbeing framework for family governance

While it can be a wonderful thing, a family is a complex constellation of relationships held together by ...

Lump sum taxation Switzerland: the requirements, taxable income and application procedure

Have you heard about a Lex Chaplin? Why should you? There has never been such a law. However, the term has ...

International estate planning strategies to reduce estate taxes

We will experience the biggest wealth transfer in history within the next three decades since Baby Boomers ...

How to elevate your single family office to excellence

The number of global single family offices is continuously rising. With the introduction of virtual family ...

Guest Series: Impact investing. Discovering underlying value

Values-based investment strategies are the zeitgeist, as more investors look towards environmental, ...

Guest Series: Private equity. How to diversify your portfolio

It may seem that private equity investors already own everything: fashion brands, food companies, computer ...

Estate planning: how to start and tackle foreign scenarios

Today is as good as any to start estate planning. For some, this post may be a reminder to focus on the ...

Residence in international tax law: Whenever, Wherever

Shakira is a Colombian pop star married to a Spanish football player and has officially been a resident in ...

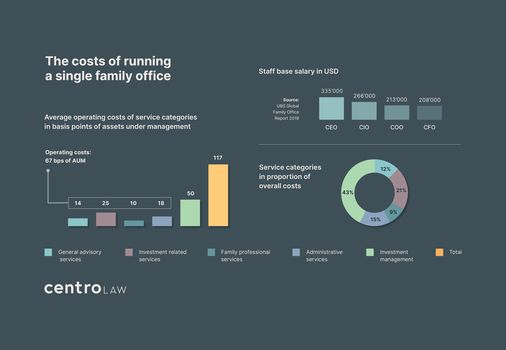

The costs of running a single family office

Cost is often predominant in the evaluation of a single family office creation. We believe that the costs ...

Guest Series: How renewable energy investments help fight climate change

Interested in knowing more about investments in renewables and energy economics?

Harikishan Mandalapu and ...

Wealth management investment products and KYC processes

In our experience, the Know Your Customer (KYC) onboarding process is the biggest bottleneck in wealth ...

Why family governance, heritage and succession planning matter

Family wealth can decline over generations for various reasons. In particular, if a family business is ...

Wealth planning strategies: why you need one

We see wealth planning as the sum of arrangements to grow, preserve, protect, and transfer wealth. It ...

What is a virtual family office?

Family offices are the zeitgeist in wealth management. Everyone has or wants one. You can choose from ...

Our blog manifesto: our goal is to provide you with value

What to expect from us.

Before we start with our regular posts, we believe it might be helpful to make a ...